Aster DM Healthcare has taken another winning leap by introducing Aster Labs. With this new venture, Aster aims to create a consortium of care for India and earn maximum market share in Indian healthcare By Raelene Kambli

Few international hospital groups have been able to dominate the India healthcare market so far. While most international groups have been expanding services by way of mergers and acquisitions, they have yet not made the right impact on the Indian population. However, Aster DM Healthcare has been an exception. The group saw the potential of the healthcare market in India and devised the right strategy to penetrate and expand its services. Today, it is one among the top 10 healthcare conglomerates in the country.

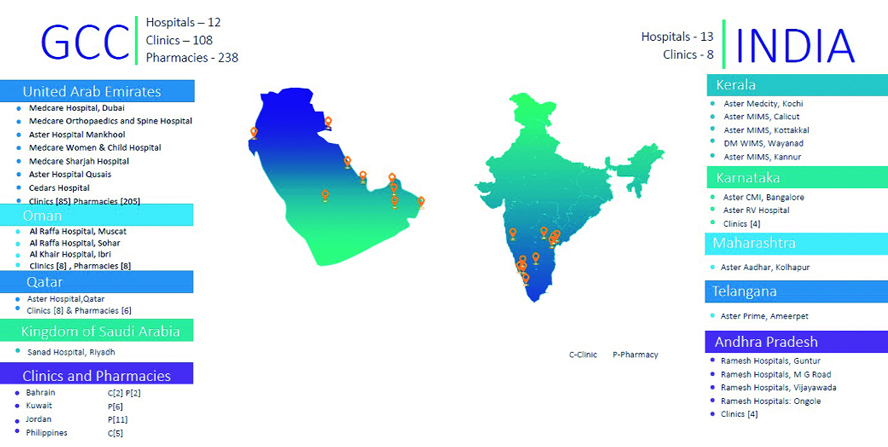

Aster DM Healthcare, starting from a single clinic in Bur Dubai in 1987, is now recognised as one of the largest private healthcare providers operating in multiple Gulf Cooperation Council (GCC ) states, Jordan, Philippines and India through its network of 25 hospitals, 116 clinics and 238 pharmacies. The group currently has 4794 beds (majority in India with 3693 beds) across 13 hospitals in India and 12 hospitals in the Middle East. It is planning to add 600 beds in Bengaluru, 500 in Chennai and 60 in Kolhapur. Besides this, there are plans to set up a new 600-bedded multi-speciality hospital in Thiruvananthapuram. Aster also went IPO last year and got a decent response from the market. Now taking another winning leap, the group is all set to introduce Aster Labs based on the hub and spoke model. Aster has earmarked Rs 40 crore as a part of the initial outlay and seems bullish on this new vertical.

They would be setting up their centralised pathology lab processing facility in Bengaluru, along with a satellite lab in the initial stages. By the end of 2020, Aster is aiming to launch one reference lab, eight satellite labs and 13 patient experience centres – mainly in the states of Karnataka and Kerala. The whole idea is to launch the centre where they have a stronger presence through local hospitals. By 2021, the hub and spoke model will be extended to other Southern states — Andhra Pradesh, Telangana, Tamil Nadu and also in Western India – Maharashtra.

The value of diagnostics for Aster

“India has around 100,000 diagnostic laboratories with an estimated Rs 60,000 crore-plus revenues generated annually, which includes pathology laboratories and radiology centres. Also, diagnostics industry has a significant part to play in the overall healthcare sector. With an aim to cater to some of the service gaps in healthcare delivery in India, we would be expanding our range of services. Our focus is to bring quality healthcare closer to the people. Also, today people have become more aware and conscious about their health and fitness. Continuous monitoring of BP, pulse reading, online health reports and predictions, maintaining a good lifestyle etc., have come in, thus giving diagnostics industry a boost. Lifestyle diseases in India are growing at a rapid pace and preventive healthcare is the only solution to it. Having said that, the industry is quite unorganised in India and the new entrant in this space has to be quite different from the rest and offer standardised services,” says Dr Azad Moopen, Founder CMD, Aster DM Healthcare while speaking about the positive outlook he has for the diagnostics sector.

Dr Moopen has a point here. India’s diagnostics sector is fragmented and traditional business models have started to stagnate. In such a scenerio, how will Aster prove themselves to be different? And, how will this new business add value to Aster’s existing business in healthcare? “Unlike the traditional ‘just screening’ model, we would be focusing more on preventive healthcare and extending the service to the homes of our customers through proper logistic arrangements. With only five per cent organised businesses in the area of diagnostics in India, we think there is a significant opportunity for consolidation. We want to build an efficient clinical testing network through a reference laboratory and hub and spoke model to ensure specimen integrity and quick turnaround times from the satellite laboratory and patient experience centres. With significant investment for the next two years, we will have a centralised pathology lab processing facility in Bengaluru by 2020,” informs Dr Moopen.

While the group has invariably focussed on accessibility of healthcare in regions where access is meagre, this new business vertical is a step to reinforce the same vision. “We are moving one step closer to people by extending our healthcare services to the homes of our customers, in terms of diagnostics through logistic arrangement. We have been consistent in our mission to provide quality healthcare and ensure accessibility. With Aster Laboratories, we want to set a benchmark for strict control measures and error-free and highest quality results with lesser turn-around time,” Dr Moopen imparts.

Aster is in the process of rolling its homecare as well as online consultation in a big way in India and GCC. The setting up of the laboratory vertical with home pick up services will add value to their businesses making them much more efficient and patient friendly. “The requirement of patients to come to clinics for even a primary consultation can be avoided if there is a robust telemedicine service where our large number of qualified doctors can provide benefit of consultation sitting at their homes. This will reduce the cost of healthcare and will be less time consuming. Also, as a responsible healthcare player, we want preventive healthcare to be at the forefront. This is a global phenomenon where healthcare players are moving towards prevention of diseases rather than just treatment. This would only be possible by giving diagnostics the required push,” he conveys.

How will this boost the company’s profitability?

According to Dr Moopen, Aster Laboratories will be able to provide holistic range of services through hospitals, clinics, pharmacies and now diagnostics. He feels that this would be more of an evolved healthcare model offering preventive and curative healthcare. “State-of-the-art technology at our centres and the timely diagnosis will help address the critical healthcare challenges of the country. Unlike standalone pathology services, we have the advantage of having a large number of hospitals and clinics where a lab is already functional. We send out many samples for advance testing to external laboratories which can be directed to our own referral lab. Moreover, the consolidation of the back-end will provide significant savings in consumables as well as manpower. These are likely to improve our existing margins,” Dr Moopen sanguinely states.

Dr Moopen further has some investment plans for Aster Labs in future. He informs that the company will require more capital as they plan to add 20 centres every year covering more geographies. Additionally, the company will be looking at acquiring local pathlabs and its chains as a part of their strategic growth plan.

So far, Aster’s growth strategy seems to be clearly defined, however, the market is very competitive. With increasing demand for diagnostics services, the competition will get tougher. The group has a strong base in southern India and is slowly venturing into the western region. Aster Labs will certainly have the advantage of a brand equity earned by the parent company in the southern states. But the challenge may lie in northern and western region where the market already has a strong network of regional and multi-state players such as Dr Lal Pathlabs, SRL and Dr Dangs in Delhi and NCR and Metropolis Healthcare and Suburban Diagnostics in Maharashtra and Gujarat. Here Aster will need to offer a great value proposition for their customers to penetrate the market and create brand loyalty.

All of this also reflects that the diagnostics sector is set to see some exciting developments. More organised players entering the market will discipline the sector and create more access for quality diagnostic services. But the question of cost and affordability will still continue to haunt patients and providers both.

Will these organised players manage to balance cost, quality and patient experience in future? Will affordable pricing, high quality services and good experience be part of Aster Labs value proposition for its customers?

Lab diagnostic’s potential in India

Lab diagnostics is increasingly becoming a prominent and profitable business segment in India. According to a research report, ‘Indian Diagnostic Services Market Outlook 2020,’ the diagnostics services market is expected to grow at a CAGR of 27.5 per cent for the next five years. As per data released by the Department of Industrial Policy and Promotion (DIPP), hospitals and diagnostics centres have already attracted Foreign Direct Investment (FDI) worth $6.09 billion between April 2000 and March 2019. In keeping with this, various industry analysts and research experts inform that the lab diagnostics sector in particular will see more funds flowing in. Growth in this sector will be mainly driven by improved healthcare facilities in the country, heightened volumes of medical diagnosis and increased number of pathological laboratories, private-public projects and the health insurance sector. Moreover, with increased public health awareness and the rising burden of chronic diseases, this market will swell to approximately Rs 860 billion by 2020.

- Advertisement -