India is at the cusp of a medtech revolution and is poised to be a net exporter like in vaccines and generic drugs

Medical devices play a role not only in screening, diagnosing and treating patients but also in restoring patients to normal lives and in regularly monitoring health indicators to prevent diseases. With technological advancements, the role of medical devices is now expanding to improve quality of care across each stage of the healthcare continuum. The healthcare industry in general has witnessed various revolutionary changes in the healthcare sector like elevated use of technology adoption. The medtech sector in India, which at the beginning of the pandemic had a bigger responsibility and faced with multiple challenges like fast-track availability, manufacturing and access of the product majorly due to dependence on other supply chains and disruption of supply and demand system. The challenges are still not over but opportunities created in the form of call for ‘Aatmanirbhar’ or self-reliance’ during the pandemic is the brighter side.

Sharing his views on medtech sector and COVID-19, Dr Sudhir P. Srivastava, MD and Founder, SS Innovations said, “The COVID-19 challenge showed us the truth about Indian dependence on imports for medical devices. Through the government of India’s flagship “Make in India” initiative, Indian medical devices industry is on the path of self-reliance or Aatmanirbharta and currently, the Indian manufacturers are working hard to meet the surged demand for healthcare equipment. At present, the med-tech industry is highly dependent on import channels, and to reduce this dependency med-tech sector needs to focus on complete self-reliance. We have to be Aatmanirbhar from acquiring raw materials to producing the end product and delivering it at the required destination. We have just started and it will take us some time to reach that level of self-reliance.”

Talking about India’s import dependence, Ankit Anand, Vice-President, Software Engineering Cloud Solution, Sleepiz India says, “A country cannot be called self-dependent if it has to depend on another geography for the healthcare of its own people. As demonstrated through the COVID 19 pandemic, having an indigenously developed vaccine has helped us achieving a feat that would have otherwise been impossible, had we depended on imports. However, for medical devices and many healthcare technologies, we are heavily import-dependent with around 80 per cent of our medical devices being imported.”

Dr Kirti Chadha, Chief Scientific Officer, Metropolis Healthcare said, “The COVID-19 pandemic has naturally shaken the foundations of India’s healthcare system as it has scrutinised even the most advanced healthcare systems around the world. Amid mounting bumps in the road, India’s healthcare system was able to withstand the pandemic. India’s various efforts in the manufacturing of medical equipment, disposables, drugs, and, most recently, vaccines have established India as a leading nation. India not only managed to meet domestic needs, but also rose to the challenge and helped other countries.

Talking about the role of medical devices, Dr S. Narayani, Zonal Director, Fortis Hospitals Mumbai said, “Medical technologies for years together have enabled early and accurate diagnosis of health problems, facilitating timely intervention and improved outcomes. Be it innovative products that replace, repair and sustain failing body functions or telemedicine and connected devices that allow remote monitoring of patient’s conditions in ICUs, OTs etc. The role of MedTech became even more important during the pandemic when MedTech married digital to address need gaps in healthcare.”

Market scenario

The Government of India has recognised medical devices as a sunrise sector under the ‘Make in India’ campaign promoting domestic manufacturing and reducing the dependency on imports. The government schemes focusing on and balancing out ease of doing business and self-reliance will play a crucial role for its further growth.

As per IBEF, India is the 4th largest market of medical devices in Asia and counted amongst the top 20 markets in the world. In 2020, the total market was estimated to be US$5.2 billion and is projected to reach US$50 billion by 2025. However, most demand for medical devices in the country is currently met through imports, comprising ~80 per cent of the total sales. This high import dependency offers an attractive proposition for domestic manufacturers. At present, the Indian companies are largely involved in manufacturing low-end products for local as well as international consumption.”

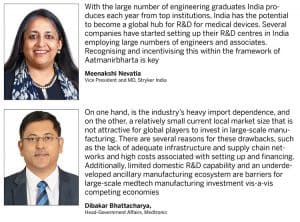

Dibakar Bhattacharya, Head-Government Affairs, Medtronic added, “the Indian medical device market is heavily dependent on imports—almost 80 per cent of the domestic requirement is imported. For high-tech medical devices, this dependency is almost 100 per cent. While India houses 14 per cent of the world’s population, it only represents 1-2 per cent of the total medical device global revenue share of leading MNCs. Therefore, on one hand, is the industry’s heavy import dependence, and on the other, a relatively small current local market size that is not attractive for global players to invest in large-scale manufacturing. There are several reasons for these drawbacks, such as the lack of adequate infrastructure and supply chain networks and high costs associated with setting up and financing. Additionally, limited domestic R&D capability and an underdeveloped ancillary manufacturing ecosystem are barriers for large-scale medtech manufacturing investment vis-a-vis competing economies.”

Highlighting the current scenario of the sector, Gaurav Agarwal, Managing Director, IITPL – Innovation Imaging Technologies said, “The current landscape is that India imports nearly 80per cent of its consumption of medical devices and is almost 90 per cent import-dependent in Medical electronics. The Indian medical device market is $11 billion and, is expected to grow at 35 per cent to become a 50 billion market by 2025, making India one of the fastest-growing medical devices markets in the world.”

“Identify areas/therapies/technologies, that have the highest import dependence and prioritise them using national disease burden. For example, cardiovascular disease is the number 1 cause of death in India. Build enabling policies like PLI, export incentives, R&D support, and incentives and support Indian medtechpreneurs innovate. The innovation ecosystem can be kickstarted by building clusters of bio incubators at institutions of academic excellence in collaboration with industry supported by grants from the Ministry of Science. This model is responsible for Israel and China’s leading medtech innovation”, he added.

Talking about the market scenario, Runam Mehta, CEO, HealthCube said, “The current market size of the medical devices industry in India is estimated to be nearly $11 billion but India imports nearly 80per cent of its medical devices. For the country to become Aatma Nirbhar in its truest sense, we need to turn it into a global medical device manufacturing hub. This can be achieved with favorable fiscal policies, Nurturing talent, stronger R&D infrastructure, and building in-house technology. From setting up manufacturing plants to sourcing raw materials, there is a need to build the whole ecosystem locally. Public-private partnerships, strong funding mechanisms, simplification of land allotment, and registration processes are essential. However, the strategy has to be built around ‘innovation.’

Dr Ravinder Deep Singh Sethi, Chief Operating Officer, Oncquest Laboratories added, “The medtech industry is highly import dependent on other countries for raw materials and now is the right time to challenge this arrangement, as companies are looking for alternative manufacturing hubs. India could be their preferred choice, provided we are able to offer a great environment. A conducive business climate with simplified land and labour laws, better infrastructure and logistics, and single window clearances can enable India to develop a full-bodied manufacturing network.”

“Though it’s a challenging business, it can be a great opportunity to attract foreign capital, latest technology, create jobs and boost our exports. Skill and scale should be the primary focus to be both quality and cost competitive and serve a global customer base”, he added

Ease of doing business & making India globally competitive in the medtech sector

The Government of India’s strategies and policies for business continuity and sectoral revival are already in place. The schemes and regulations allowing 100 per cent FDI aiming at global investors to choose India as their preferred destination for investments are driving the sector. This is also important as there is increased demand for technologically advanced, high-quality, low-cost medical devices that are accessible to the Indian population. These factors are also attracting international companies to set up production facilities in India. However, there are still some unexplored challenges and areas that needs attention.

Talking about the need of the hour in this direction, Dr Srivastava said, “As many countries are looking into investing in offshore manufacturing units, India could be their preferred location because of the availability of trained manpower. Added to that, if we provide a promising business environment with simplified labour and land laws, better infrastructure and logistical support, along with single-window clearances on permissions and tenders, then it will be beneficial. Foreign capital will bring in the latest technology, create new job opportunities and boost exports. The medtech sector will grow considerably and, will also move towards self-reliance by getting at par with other global suppliers.

Sharing his views on the same, Dr Veeraal Gandhi, Chairman and Managing Director, Voxtur Bio said, “The key challenges for the industry are dearth of infrastructure and logistics services, inadequate supply chain services and high cost of finance. The government has always been supporting the industry by simplifying regulations and paperwork. The introduction of the production linked incentive scheme (PLI) encouraging domestic manufacturing of medical devices has enhanced growth prospects immensely. The industry needs continued financial assistance and policy support from the government. An enabling eco-system must be created so that the companies can leverage emerging collaborative growth opportunities.”

Highlighting the challenges, Nimith Agrawal, Founder, DoctCo added, “The medtech industry struggles with low penetration. The demand primarily comes from metro cities as there is low penetration in tier 2,3 cities and rural areas due to lack of awareness, availability, and affordability. Hospitals in non-metro cities opt for cheaper products compared to high-end products owing to costs and affordability issues. Moreover, the per capita spend on this sector is significantly lower. Public healthcare infrastructure receives inadequate investments making it inefficient and creating a lack of medical devices and equipment. Consequently, the medtech sector gets affected as distribution becomes challenging.”

Soumya Sunder Dash, CEO and Co-founder, Sleepiz AG added, ““Where there are challenges, there are opportunities. I would say opportunity is the other side of a challenge. And in India, there is no dearth of either. You just have to be perceptive and perseverant enough to drive your dream and believe that dreams do come true!”

Talking about the opportunities in this direction, Meenakshi Nevatia, Vice President and MD, Stryker India said, “About 80-85 per cent of the medical devices are currently imported. While it is important for the government to provide incentives to stimulate local manufacturing to reduce import dependency in the medium to long term, the very high duties (basic customs duties plus 5per cent health cess) is resulting in viability challenges for the industry to continue providing technologies at affordable prices and ensuring access to latest technology. Finding a balance here is key.

Medical devices regulations: Areas that still need attention

The medical devices regulation is the key parameter in India’s medtech sector journey of excelling in meeting the global standards. However, the majority of industry still believes that there still is a scope of improvement.

Sharing his views on medical device regulations, Dr Srivastava added, “The Government of India has brought in many new policies and measures to encourage domestic manufacturers. But the regulations of the medical device are still not very streamlined and need a lot of clarity in how it should function. Currently, sixteen medical devices are regulated under MDR (Medical Devices Regulation), 8 others are regulated as drugs and 13 additional devices are going to be added to the MDR over 2021. The major concern for the industry is about the pace at which medical device regulation works. Although it’s a great move to regulate all medical devices we have to make sure that the registration process is simplified. As the delays (such as delays on part of the CDSCO in granting import and manufacturing licenses before the end of the 30/42-month exemption period) will lead to financial loss and deficit in the supply chain endangering the health of patients.”

“The Indian medical devices industry is now becoming increasingly conducive to setting up manufacturing facilities. In the year 2017, the Government of India introduced The Medical Device Rules (MDR), 2017 and revamped the regulatory framework to make it competitive to the international norms. All these regulatory measures have reduced the time and effort needed to start the production. The permission of 100per cent automatic FDI in the medical devices sector and establishment of MedTech Zonesis further boosting domestic manufacturing. That being said, the pace of reforms is quite slow and the need for reform is pressing. For instance, no more than 29 devices have been brought under the purview of MDR whereas there are more than 1700 categories of medical devices in the world market”, added Mehta.

Stressing on the challenges, Agarwal says, “There are many challenges as far as Indian medtech regulations are concerned, which result in creating obstacles in indigenous medical device manufacturing in India including unfavorable duty structure, Inadequate domestic demand for certain segments/product categories, complexity and lack of transparency in regulation, lack of comprehensive laws and lax enforcement mechanisms for IP protection, absence of indigenous ‘quality certification’ authority and unavailability of proper ecosystem support (suppliers, raw material, etc.) for medical device manufacturing.”

Dr Gandhi suggested, “Because of the MDR 2017, the medical devices sector has excelled in meeting the global standards. A comprehensive regulatory framework taking into account both the medical devices and manufacturing processes will further enhance the global acceptability of the medical devices manufactured in India.”

Talking about the need of the hour in this direction, Dr Chinmaya P Chigateri, Director & CEO, Healthminds Consulting added, “A set of robust regulations for the pharma sector helped India to become one of the world’s leaders in generic drugs via a regime of price controls, process patents and industrial promotion policies. The need of the hour is to create a similar, independent framework for medical devices and software to reduce the dependence on imported medical technology and create an opportunity for Indian companies to thrive.”

Entering the post-pandemic phase and need of the hour

In order to realise the growth spectrum, the medtech sector needs to further improve infrastructure and logistics networks and to enhance the supply chain ecosystem. Moreover, there’s a need for effective collaboration across value chains for facilitating innovation and introducing new products that expand the sector to its potential of USD 50 billion by 2025.

Stressing on the need of bringing strong emphasis on R&D and innovation, Nevatia added, “With the large number of engineering graduates India produces each year from top institutions, India has the potential to become a global hub for R&D for medical devices. Several companies have started setting up their R&D centres in India employing large numbers of engineers and associates. Recognising and incentivising this within the framework of Aatmanirbharta is key. Also, there is a great opportunity for collaboration and partnerships with Indian institutions – a strong funding mechanism becomes imperative which can be achieved through capital subsidies and tax incentivisation.”

Talking on the similar lines, Bhattacharya said, “India produces one of the largest numbers of STEM graduates in the world. This means the availability of an excellent talent pool for investing in global-scale R&D activities. For the R&D sector particularly, India provides significant ease-of-doing-business factors and those can be further strengthened by bringing in national-level policy and incentives for investors. India also has an extremely vibrant start-up ecosystem that can be tapped for introducing market appropriate medtech innovations. A structured partnership program among academia, start-up ecosystems, and global medtech players can help bring sustainable and affordable innovations across the healthcare system.”

Rajneesh Bhandari, Founder NeuroEquilibrium added, “Reversing the trend of adopting medical technology from developed countries, India is becoming a hotbed of health tech and medtech innovation. Instead of reverse-engineering western products, now Indian innovators are going global with unique and path-breaking medtech products and solutions. There are over 3000 healthtech/medtech startups in India, many of which are looking to build global products and services. As a result, India has reached an inflection point, and we will see more innovative startups come up and find global markets.”

A creation of flexible supply chain and focus on their management is the need of hour for better patient outcome and positive business outcomes.

- Advertisement -