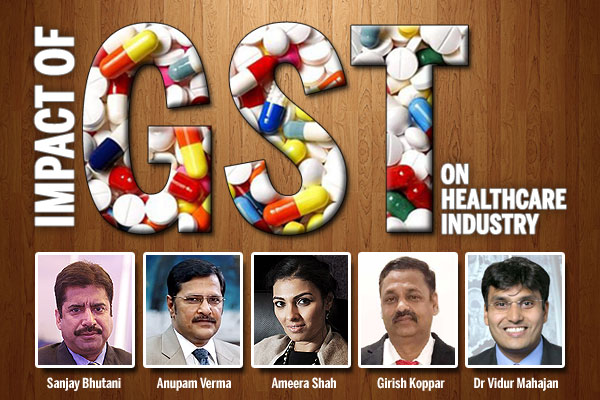

Post GST roll-out, healthcare industry leaders share their views on the change in taxation, giving their insights on whether GST is a boon or a bane

Sanjay Bhutani, Board Member, MTaI

“The medical devices sector can expect a higher tax burden due to the proposed GST rates, subsequently resulting in a higher cost burden to the patients,” says Sanjay Bhutani, Board Member, Medical Technology Association of India (MtaI).

“The medical devices sector can expect a higher tax burden due to the proposed GST rates, subsequently resulting in a higher cost burden to the patients,” says Sanjay Bhutani, Board Member, Medical Technology Association of India (MtaI).

“Under the current regime, the medical devices category attracts central excise/ countervailing duty (CVD) rate of 0 – 12.5 per cent, and the value-added tax (VAT) rate for all devices is five per cent. Consider two scenarios where a medical device attracts a CVD rate of zero per cent and six per cent, the embedded tax rate approximately comes to 7.5 per cent and 10.7 per cent respectively after considering a central sales tax (CST) at two per cent, VAT at five per cent and Octroi, entry tax etc.

The assertion that medical devices including surgical instruments would have a lower tax burden with GST rate pegged at 12 per cent instead of 13 per cent (which includes six per cent CVD and five per cent VAT besides the CST, Octroi and entry tax, etc.) is based on a simple addition of all taxes subsumed into GST. This, however, is without considering the fact CVD is levied at the first point (i.e. at the import price), CST on the billing price from the company to the distributor, and the VAT is levied at the last point (i.e. at the value at which the goods are finally sold to customers).

The medical devices including surgical instruments, therefore, will roughly have an additional tax burden of 4.5 per cent to 1.3 per cent as per the above two examples.

Anupam Verma, President, Wockhardt Hospitals

“Healthcare services have been exempted from GST to a large extent. Therefore the status by and large would be as before. However, there is a change in the inputs costs for the service provider in terms of increase of tax on outsourced services like housekeeping, security etc. This would push the costs of treatment upward. We have yet to analyse the impact of change in prices of medicines and consumable. This factor would entirely depend on the manufactures who will be fixing the prices afresh. By the information so far, on this account, the impact on the cost to the patient should be very marginal.”

“Healthcare services have been exempted from GST to a large extent. Therefore the status by and large would be as before. However, there is a change in the inputs costs for the service provider in terms of increase of tax on outsourced services like housekeeping, security etc. This would push the costs of treatment upward. We have yet to analyse the impact of change in prices of medicines and consumable. This factor would entirely depend on the manufactures who will be fixing the prices afresh. By the information so far, on this account, the impact on the cost to the patient should be very marginal.”

Ameera Shah, MD, Promoter, Metropolis Healthcare

Under Goods and Services Tax (GST), healthcare services are referred to as any service by way of diagnosis or treatment or care for illness, injury, deformity, abnormality or pregnancy as per recognised systems of medicine in India. They also include services by way of transportation of the patient to and from a clinical establishment. Given this, the healthcare sector had speculated, debated and discussed about implications of the impending GST Bill. The decision of the Indian government to exempt healthcare services from GST has been good news for start-ups as well as established healthcare businesses. However, for the end-consumer the costs could rise, given the increase in input costs as proposed by GST. As per the GST regime, the tax rate for medical devices sector was pegged at 12 per cent, which could affect the overall cost structure of the healthcare chain.

Under Goods and Services Tax (GST), healthcare services are referred to as any service by way of diagnosis or treatment or care for illness, injury, deformity, abnormality or pregnancy as per recognised systems of medicine in India. They also include services by way of transportation of the patient to and from a clinical establishment. Given this, the healthcare sector had speculated, debated and discussed about implications of the impending GST Bill. The decision of the Indian government to exempt healthcare services from GST has been good news for start-ups as well as established healthcare businesses. However, for the end-consumer the costs could rise, given the increase in input costs as proposed by GST. As per the GST regime, the tax rate for medical devices sector was pegged at 12 per cent, which could affect the overall cost structure of the healthcare chain.

Although hospital services are exempted from taxes under GST, the outsourced services, aesthetics and outpatient pharmacies are subject to GST imposition. In the pharmaceuticals landscape, the 5 per cent tax rate on life-saving drugs that treat diseases like malaria, HIV-AIDS, tuberculosis, and diabetes is expected to marginally increase the price of medicinal drugs, leading to a domino effect in the cost structures for healthcare sector. While this shift is dramatic enough, I am glad that the GST council has decided to make the transition as smooth as possible for India, by not moving the tax needle too drastically on the healthcare related goods and services segments.

Girish Koppar, Secretary, Hospital Information Technology Association

The healthcare industry has been exempted from the goods and services tax altogether and no GST can be levied on healthcare services by a clinical establishment. Hence, it can be said that the healthcare sector is insulated from GST, except for the software application front where tweaking is required in the application to accommodate the statutory requirements. The only area where GST will have some impact is the hospital sector and it is on the amount of taxes levied on cosmetic services, which has been increased from 15 per cent to 18 per cent.

The healthcare industry has been exempted from the goods and services tax altogether and no GST can be levied on healthcare services by a clinical establishment. Hence, it can be said that the healthcare sector is insulated from GST, except for the software application front where tweaking is required in the application to accommodate the statutory requirements. The only area where GST will have some impact is the hospital sector and it is on the amount of taxes levied on cosmetic services, which has been increased from 15 per cent to 18 per cent.

It is anticipated that the cost on imports of medical equipment may come down marginally. The pharma sector will be benefited by the implementation of GST as the tax structure would be considerably simplified. This in turn will lead to better operational efficiency and streamlining of supply chain.

It will take some time for the vendors and manufacturers to ascertain the impact of GST on their margins and their manufacturing costs. Once they are able to ascertain the impact of GST on their margins then they need to decide whether to pass on the benefits/ losses to the end users. It will probably take a couple of weeks for the vendors and manufacturers to ascertain their costs and margins as applications are not fully modified to comply to GST.

Hence, the real impact on the end user or patients, in case of the hospital industry, will be clear in a few weeks once the vendors and manufacturers are able to ascertain their profit margins. Data will get uploaded on government portals and further detailed clarification will be received from the government on a micro level.

Dr Vidur Mahajan, Associate Director, Mahajan Imaging

Radiology and imaging, along with in-vitro diagnostics, form the backbone of any healthcare system since prudently performed diagnostic tests lead to accurate treatment. Not only does this lead to improved clinical outcomes for patients, but it also leads to lower healthcare expenditure in the long run since patients are given only the best, most appropriate treatment.

Radiology and imaging, along with in-vitro diagnostics, form the backbone of any healthcare system since prudently performed diagnostic tests lead to accurate treatment. Not only does this lead to improved clinical outcomes for patients, but it also leads to lower healthcare expenditure in the long run since patients are given only the best, most appropriate treatment.

Unfortunately, the GST rates on healthcare equipment and allied items are sending the opposite signal. There has been an increase in almost all indirect taxes that a healthcare provider will have to pay. Radiology, specifically, will be affected on three counts. First, there is an increase in tax on import of medical equipment to the tune of five per cent. While this is in line with the government’s plan to promote manufacturing in India, high-end equipment like MRI scanners, CT scanners etc., it will take a long time to be developed and manufactured in India and this increase in tax is instead de-incentivise healthcare providers from bringing in cutting-edge equipment. Secondly, there is an increase in effective tax rate of 10 per cent on comprehensive maintenance contracts which are critical for maintaining all equipment and ensuring high quality diagnostics. Lastly, there is a general increase in effective tax on most consumable purchases made by healthcare providers such as spare parts, catheters, needles, pumps and even diagnostic kits.

It is important to realise that the healthcare industry is already under tremendous price pressure, and increasing the tax on purchases critical to the industry will only further negatively impact the already stressed bottom-lines of healthcare. Also, it is important to note that passing-through the impact of increased taxes onto patients is extremely difficult and might even be considered wrong by many. In an era when we need our country’s brightest and best to come into the healthcare sector, is this really the right approach?

(With inputs from Mansha Gagneja)

- Advertisement -

Comments are closed.