There was one transaction from India – Firstsource Solutions, a provider of Business Process Management (BPM) services, acquired PatientMatters, a healthcare Revenue Cycle Management (RCM) solutions provider for $13 million.

Total corporate funding for digital health companies – including VC, debt, and public market financing – reached $21.6 billion in 2020 while debt and public market financing increased 278 per cent, with $6.8 billion raised in 26 deals, compared to $1.8 billion in 20 deals in 2019.

Seventy-seven percent of the sector’s funding went to US companies in 2020, with $11.5 billion in 429 deals compared to $5.9 billion in 426 deals in 2019, a 95 per cent increase in year-over-year (YoY) funding. Chinese companies recorded $1.1 billion in eight deals. Thirty-eight countries recorded digital health VC funding activity in 2020.

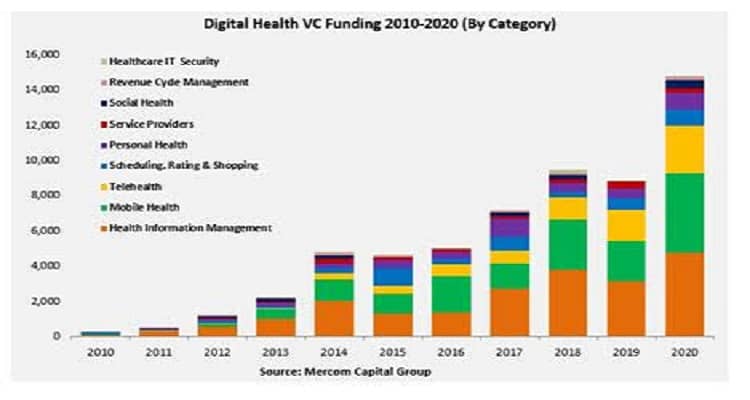

Since 2010, digital health companies have received $59 billion in VC funding in over 5,000 deals and almost $21 billion in debt and public market financing (including IPOs), bringing cumulative investments into the sector to approximately $80 billion. In 2020, there were 38 large funding deals of $100 million or more, accounting for 40 per cent of the total funding.

“COVID-19 supercharged funding activity in digital health in 2020. Ten digital health categories had their best year with record funding amounts. It was also the biggest year for IPOs with six digital health companies raising over $6 billion. We could see a lot more companies going public in 2021 if the current IPO and SPAC boom continues,” commented Raj Prabhu, CEO, Mercom Capital Group. “The pandemic has mainstreamed the consumer side of digital health technologies in less than a year. Digital health products that were a novelty a year or two ago are now a necessity.”

Consumer-centric companies brought in $9.6 billion in 2020, up 81 per cent YoY. Practice-centric companies raised $5.3 billion a 47 per cent increase compared to 2019.

In 2020, telemedicine was the top-funded category and led VC funding activity with $4.3 billion, a 139 per cent YoY increase compared to $1.8 billion in 2019. Other top-funded categories in 2020 included: Data Analytics with $1.8 billion, mHealth Apps with $1.4 billion, Clinical Decision Support with $1.2 billion, Practice Management Solutions with $837 million, Wearable Sensors with $815 million, Wellness with $792 million, Healthcare Booking with $765 million, and Social Health Networks with $500 million.

The top VC funding rounds in 2020 included: $500 million raised by DXY, $285 million raised by ClassPass, $250 million raised by Alto Pharmacy, $226 million raised by Olive, and $214 million raised by SomaLogic.

A total of 1,694 investors participated in Digital Health deals in 2020 compared to 1,288 investors in 2019. The top investors in 2020 were: Optum Ventures with 15 deals, General Catalyst with 14 deals, and Oak HC/FT with 13 deals. GV (formerly Google Ventures) and Sequoia Capital made 11 investments each.

2020 was the biggest year for IPOs in Digital Health.

Six companies went public, raising a total of $6.2 billion: JD Health ($3.5 billion), GoodRx ($1.3 billion), Amwell ($922 million), Accolade ($220 million), NanoX ($165 million), and MindBeacon ($58 million). This is the highest number of IPOs in digital health in a single year to date.There were 184 M&A transactions in 2020 compared to 169 in 2019, a nine percent increase in deal activity. Eighteen companies participated in multiple transactions in 2020.

Practice Management Solutions companies led M&A activity with 25 transactions, followed by Telemedicine companies with 23 transactions, mHealth App companies with 19 transactions, and Data Analytic companies with 18 transactions.

Two hundred ninety-six companies have made multiple acquisitions from 2010 to 2020, and 51 companies have acquired five companies or more.

The top five disclosed M&A transactions in 2020 were: Teladoc’s acquisition of Livongo Health for $18.5 billion, Blackstone’s acquisition of a majority stake in Ancestry for $4.7 billion, Philips’ acquisition of BioTelemetry for $2.8 billion, Invitae’s acquisition of ArcherDX for $1.4 billion, and WellSky’s acquisition of Allscripts’s CarePort Health (CarePort) business, for $1.35 billion.

- Advertisement -